Payment management has undergone significant transformations thanks to the emergence of innovative technologies. Stripe, a major player in this field, has managed to transform and simplify the world of online transactions. With tools tailored to the needs of modern businesses, Stripe allows organizations to automate their payment processes, enhance customer experience, and increase operational efficiency. Through its integrated approach and advanced features, Stripe redefines the way companies manage their payments, minimizing risks while maximizing customer satisfaction.

With Stripe, payment management is experiencing a real transformation through an automated and integrated approach. This platform enables businesses to simplify the processing of online payments, automate invoicing, and manage recurring payments, thus offering greater flexibility to their customers.

By integrating Stripe into their management systems, companies can optimize customer experience, reduce the time spent on payment reminders, and decrease the risks of fraud. The suite of tools offered by Stripe adapts to the needs of each organization, facilitating the payment process and increasing conversion rates.

Moreover, Stripe provides an advanced dashboard that allows for precise and efficient performance tracking and ensures optimal security for transactions, making it a preferred solution for companies looking to improve their payment management.

In an increasingly digitalized world, payment management has become a central issue for businesses, whether large or small. Thanks to the innovative technology of Stripe, the way companies conduct transactions has been profoundly transformed. Stripe simplifies the process of processing online payments, making this task not only faster but also more secure and efficient.

Table of Contents

ToggleAn Intuitive and Accessible Interface

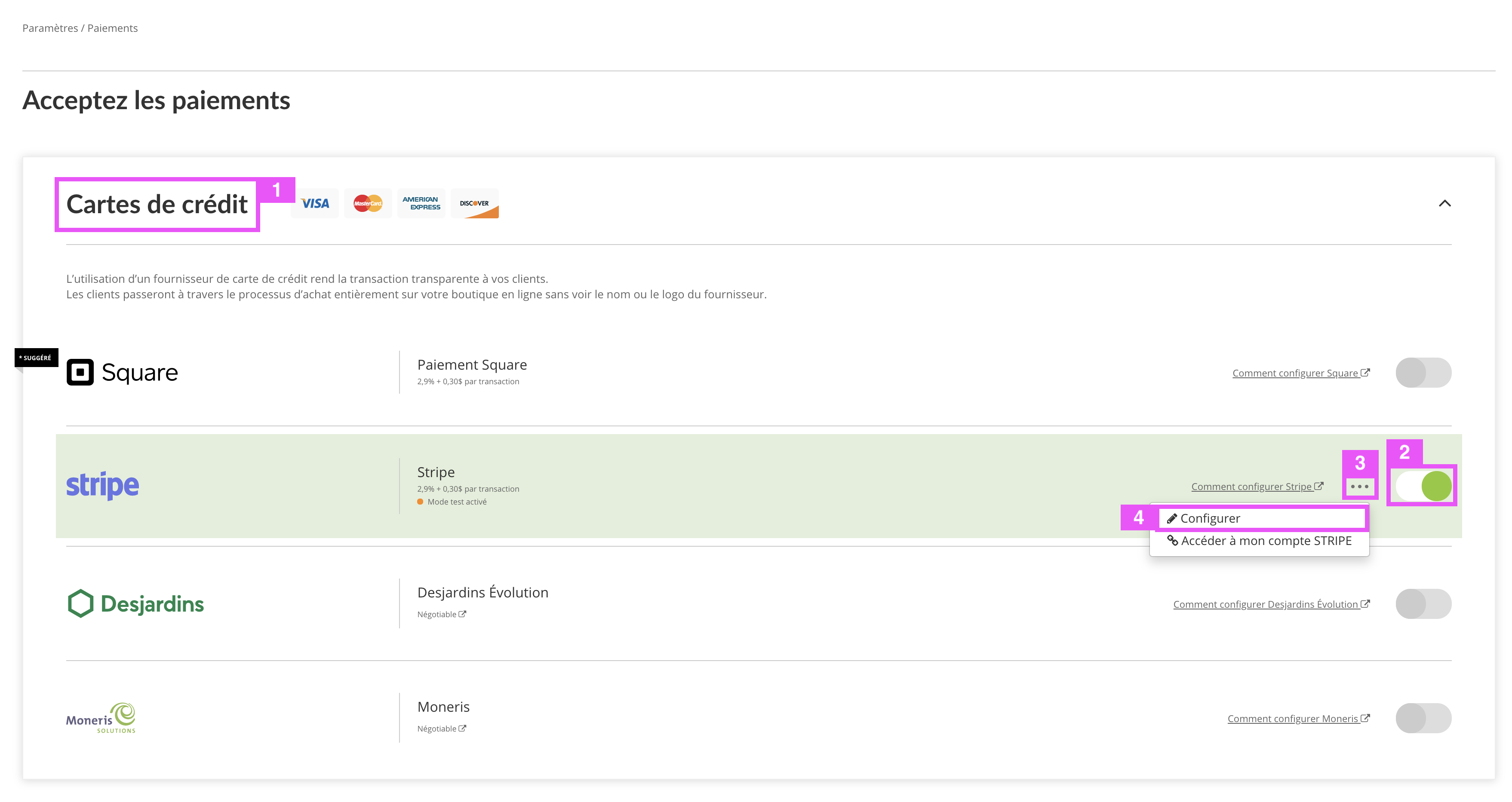

At the heart of the revolution promised by Stripe is its ability to offer an intuitive and user-friendly interface. Users, whether developers or managers, can easily navigate through the Stripe platform, reducing the time required to set up payment solutions. Moreover, integration with different platforms is also simplified. For example, integrating Stripe with modern CRMs like Furious allows companies to manage their transactions directly from their familiar work environment, making the payment process smooth and fast.

This ease of use is not only beneficial for companies in terms of efficiency but also improves the customer experience. A pleasant user experience is crucial for customer loyalty, and Stripe contributes effectively to this with its consumer-focused approach. Users can make payments in just a few clicks, thereby reducing cart abandonment and increasing conversions.

Automation of Financial Processes

Another essential aspect of payment management via Stripe is the automation of financial processes. With features like Stripe Billing, companies can automate invoicing, recurring payments, and reminders, allowing them to focus on other strategic tasks. This automation helps reduce human errors and increases teams’ ability to handle larger volumes of transactions without a proportional increase in human resources.

Companies can also set up automatic refunds and payment notifications, thereby improving communication with their customers. Furthermore, managing subscriptions becomes simplified thanks to this technology. Businesses can manage different types of subscriptions and modifications without needing frequent manual interventions, optimizing staff time and resources.

Securing Transactions

Security is undoubtedly one of the pillars of consumer trust when it comes to online payments. Stripe has developed an infrastructure designed to minimize fraud risks. With advanced security protocols, Stripe ensures that customers’ financial information is protected. The integrated fraud prevention systems analyze transactions in real-time, allowing for the detection of anomalies and rapid action if necessary.

Moreover, secure payment without visible credit card files further enhances users’ trust in the platform. Businesses can thus reassure their customers about the protection of their sensitive information, attracting more consumers to their brand. Stripe‘s reputation for security has been highlighted in various media outlets, reinforcing its position as a leader in online payment, as illustrated by this article on the story of Stripe.

In terms of reporting and analysis, Stripe provides clear and graphical dashboards that allow users to track the performance of their transactions and identify trends in purchasing behavior. Through integrated analysis tools, companies can adjust their marketing strategies based on the collected data, thereby strengthening their position in the market.

In summary, the revolution of payment management by Stripe is based on an accessible interface, automation of processes, and enhanced security. Companies that adopt this platform benefit from a robust and integrated solution that allows them to focus on their growth while optimizing their financial management.