Retailers are getting creative to entice brands and secure their investment in retail media networks. They are developing streaming capabilities and exploring new channels, hoping that this will open the doors to the coveted brand budgets. However, advertisers still show a certain reluctance. Measuring performance and return on investment remain crucial issues to address. Calls for more transparency and accountability are increasing as brands cautiously assess the effectiveness of these new marketing arenas.

Retailers, like Walmart with its acquisition of Vizio, are intensifying their efforts to attract brand investments through the integration of new streaming capabilities. However, despite these initiatives, advertisers remain cautious about releasing budgets dedicated to brand marketing. Indeed, retail media networks face significant challenges in terms of performance measurement and return on investment. As long as these issues are not resolved, brands will hesitate to allocate substantial resources to these new advertising avenues.

Table of Contents

Togglethe rise of retail media networks

Retailers are constantly innovating to capture the attention of brands and their advertising budgets. With Walmart’s acquisition of Vizio, a new chapter opens, offering unprecedented advertising possibilities through streaming technologies. This trend fits into a larger movement where retail media networks are proliferating, seeking to leverage budgets allocated to digital platforms.

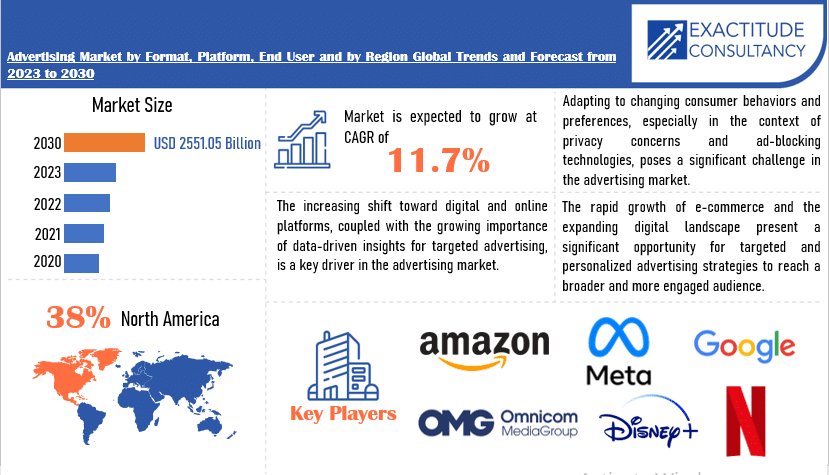

The major challenge remains the implementation of systems capable of providing a precise measurement of advertising return on investment. Advertisers need guarantees before committing significant brand budgets to these new opportunities. Therefore, there is strong pressure on retailers to provide tools comparable to those of giants like Meta and Google.

The promise of Walmart and other market players is to stand out not only through the effectiveness of their conversion channel but also by venturing into the top of the funnel, a space traditionally reserved for brand awareness campaigns. A bold bet that requires a well-orchestrated strategy and relevant investments in technology.

the persistent skepticism of advertisers

Despite retailers’ efforts, advertisers remain cautious in the face of this new advertising gold mine. Why invest in an unproven channel when traditional alternatives continue to deliver solid results? This question resonates strongly in discussions around brand budgets, currently slowing the influx of these precious investments into retail media networks. Uncertainty regarding transparency and data traceability remains a significant obstacle.

The introduction of new advertising channels on social media and streaming by large retailers has not yet dissipated these fears. Advertisers are seeking complete visibility into the impact of their spending, an expectation that retail media networks have yet to meet. While waiting for concrete solutions, skepticism persists, placing retailers in a race against time to convince.

perspectives and future strategy

With a market valued at over 129 billion dollars by 2028, the growth potential of retail media networks is undeniable. However, this projected growth may hit a ceiling if retailers fail to prove their ability to generate a return on investment comparable to that of digital giants. Brands demand rigorous analyses and transparent reports on the effectiveness of their advertising placements.

Discussions around budgeting for advertising campaigns will continue to evolve based on the results delivered by these new channels. With substantial amounts at stake, each player will need to entice with clear proposals and demonstrable performance. The interplay between technological innovation and marketing efficiency will make the difference in attracting massive and sustainable investments.